Microfinance

Microfinance

Microcredit in Bangladesh

Any agency the Government does not control can be regarded as an NGO. The public perception of Non-Governmental Organizations (NGOs) is that they work for the common good of individuals or groups. The history of NGOs in Bangladesh can be traced back to the British colonial period. Since the British era, NGOs in their traditional form have worked in Bangladesh as different religious trust-based schools, hospitals, and orphanages. However, NGOs in Bangladesh radically transformed and became development agents in the post-independence era. Since the 1970s, NGOs have become part of Bangladesh's institutional poverty alleviation framework. The NGO sector in Bangladesh is an inseparable part of our society. Gradually, NGOs started to work in the field of group formation, credit, formal and non-formal education, health and nutrition, family planning and MCH (Mother and Child Health), gender development, poultry and livestock, agriculture, sanitation, environment, human rights, advocacy, legal aids, and many other fields. Untiring efforts and intrinsic zeal have led NGOs to assist the poor in poverty alleviation and to empower them in every aspect of social life.

In particular, various statutory and administrative regulations exist in Bangladesh for registration, prior review, project approval, and utilization of foreign funds by NGOs. These are the authentic sources of NGO functioning. The legal framework has two primary dimensions: one is laws for incorporation and providing legal entity to NGOs, and another is laws governing the relationship of NGOs with the Government. NGOs in Bangladesh are registered under different Acts. These are (1) The Societies Registration Act, 1860; (2) The Trust Act, 1882; (3) Voluntary Social Welfare Agencies (Regulation and Control) Ordinance 1961; (4) Co-operative Societies Act, 1925; and (5) The Companies Act, 1913 (amended in 1914). NGOs registered under these acts as mentioned above are controlled by (1) The Voluntary Social Welfare Agencies (Regulation and Control) Ordinance 1961; (2) The Foreign Donation (voluntary activities) Regulation Ordinance, 1978 (amended in 1982) and (3) The Foreign Contribution (Regulation) Ordinance, 1982. The highest number of NGOs is registered under The Societies Registration Act 1980. The NGO Affairs Bureau (NGOAB) was established in 1990 with the authority to register and regulate all NGOs operating with foreign funds in Bangladesh. Difficulties and inconsistencies have emerged with many laws, ordinances, rules, and regulations for NGO operations. The whole legal framework needs to be revamped to promote a healthy NGO sector and strengthen the national context for increased government-NGO collaboration and partnership for the betterment of the people.

In Bangladesh, the Microcredit Regulatory Authority (MRA) holds the exclusive mandate as the sole regulatory authority overseeing the microfinance sector. Its purview extends across the industry, except banks and select government entities that follow their distinct regulatory frameworks. Presently, the microfinance landscape in the country boasts a diverse range of participants, including Microfinance Institutions (MFIs) licensed by the MRA, the renowned Grameen Bank, Commercial Banks, and various governmental agencies. In the fiscal year 2023-2024, these entities collectively impacted 69.35 million individuals, providing services encompassing credit, deposits, and many social development initiatives. These services are indispensable in nurturing micro-entrepreneurship, elevating human resources, and fostering employment opportunities. Crucially, they have significantly contributed to Bangladesh’s financial inclusion efforts, embracing a remarkable 42.05% of the total population within their ambit. While MRA-licensed MFIs dominate the microfinance sector, the contributions of other organizations remain noteworthy. These microfinance entities can be classified into four distinct categories:

MRA Licensed MFIs: The Microcredit Regulatory Authority (MRA), Bangladesh’s sole regulatory authority for the microfinance sector, has given 882 licenses to qualified MFIs and Cancelled 151 due to non-compliance as of 30 June 2024. Within the MRA’s jurisdiction, 731 MFIs are actively engaged in providing microcredit services to an impressive 40.86 million individuals. As of the same date, the cumulative loan outstanding reached BDT 1504.20 billion, with a substantial total loan disbursement of BDT 2493.02 billion recorded. Additionally, these MFIs collectively held total savings amounting to BDT 620.55 billion. This expansive presence underscores MRA-licensed MFIs' commitment to promoting financial inclusion and empowering individuals, particularly those in underserved communities, by providing them with access to essential banking services.

Microfinance at People’s Welfare Foundation

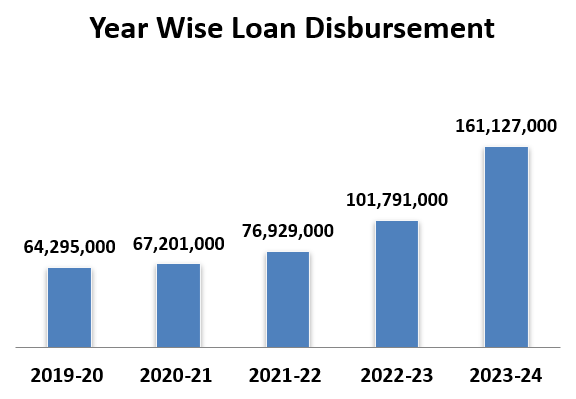

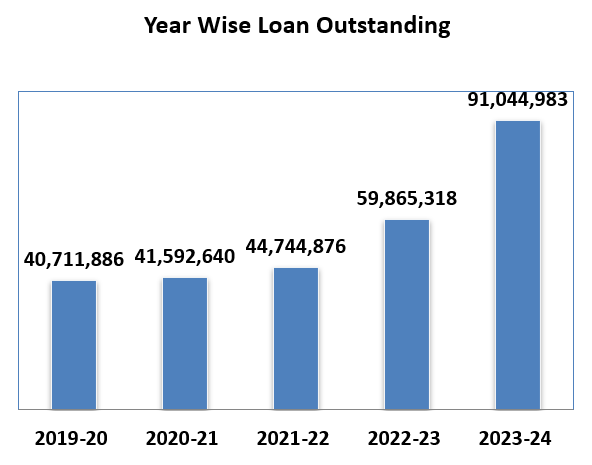

The organization's Microfinance Program (MFP) began in 2004. It has now been scaled up and winged with other projects to realize the availability of financial services for poor households, reduce vulnerability, and help poor people increase their income. The project has focused on improving rural poor people's income by providing them with the required financial support. The microcredit loan disbursement is mainly made through Jagoron, Agrosor, Agriculture, etc.

The microfinance activity has been designed to benefit the family, with a particular emphasis on children and women. People's Welfare Foundation has been providing micro-credit to its group members through a systematic process generally accepted in the country. As a systematic process, micro-credit has developed a very effective monitoring system so that the activity is kept on the right track and does not fall into problems due to lack of proper supervision and management. The realization has been scheduled on a weekly & monthly basis, and the realization rate is 99.53%. People's Welfare Foundation provides a basic orientation to the group members to understand the microfinance system and their role as a borrower. People's Welfare Foundation field area has a massive demand for micro-finance. The Microfinance program is supported by the People's Welfare Foundation's fund, Palli Karma-Sahayak Foundation (PKSF), Mac Foundation, Bangladesh Commercial Ltd., Mercantile Bank Ltd., Puabli Bank Ltd., Midas Financing Ltd. & local borrowed fund.

Goals of the program

The primary goal of the Microfinance program is to promote sustainable socio-economic development in the lives of people with low incomes, landless people, and disadvantaged people; their excellent plans, implementation, and proper resource allocation help them attain a dignified livelihood in the family and society as a whole.

Objectives

The following are the objectives of the Micro-finance Program:

- To organize female groups for empowerment;

- To develop financial strength of rural and slum disadvantaged target people;

- To develop leadership skills and management core competency;

- To improve the gender issue and the human rights situation;

- To improve child development (establishment of child rights in the family through microcredit and entrepreneurship and awareness development);

- To develop consciousness, group management, leadership development, and skill development for IGAs;

- To establish an ecologically balanced environment.

Areas of Micro Finance Program

|

# |

Name of Branch |

Name of District |

Name of Upazila |

No. of union Covered |

No. of Covered Village |

Total No. of staff |

|

1. |

Kaitra with the Head office |

Cumilla |

Laksam, Barura and Lalmai |

8 |

32 |

10 |

|

2. |

Laksam |

Cumilla |

Laksam and Lalmai |

8 |

30 |

5 |

|

3. |

Bagmara |

Cumilla |

Lalmai, Cumilla Sadar South and Laksam |

9 |

43 |

6 |

|

4. |

Kashinagar |

Cumilla |

Chaddagram, Lalmai and Cumilla Sadar |

6 |

33 |

4 |

|

Total3

|

31 |

138 |

25 |

|||

Activities

Institution building at the grassroots level

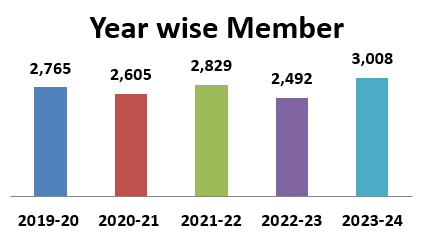

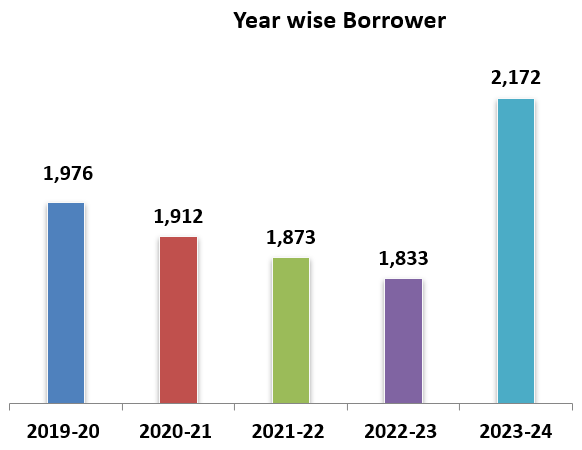

The group formation activity is being implemented under the Cumilla district. People’s Welfare Foundation has been actively involved in forming and nursing village-level groups, particularly in the poorer section of the community. The poor female inhabitants of the target villages include the village-level group. Each of the groups contains a membership of 10-30. People’s Welfare Foundation has 197 village organizations with a membership of 3,008. The borrower of those members is 2,172.

Weekly village group meeting

The weekly group meeting is an essential tool for organizing, mobilizing, utilizing, and raising awareness of poor people, which is fruitful to carry forward all development activities. The group meeting is the focal point of all decision-making and all development issues, including microfinance. People’s Welfare Foundation’s microfinance is implemented through a group model whereby members form groups of five and subsequently form centers of roughly six groups. Community Organizer holds village organization (VO) meetings each week.

Weekly village group meeting

The weekly group meeting is an essential tool for organizing, mobilizing, utilizing, and raising awareness of poor people, which is fruitful to carry forward all development activities. The group meeting is the focal point of all decision-making and all development issues, including microfinance. People’s Welfare Foundation’s microfinance is implemented through a group model whereby members form groups of five and subsequently form centers of roughly six groups. Community Organizer holds village organization (VO) meetings each week. An increase of 512 members from FY 2022-2023 to FY 2023-2024 due to some inactivity issues.